Dear

Trader…

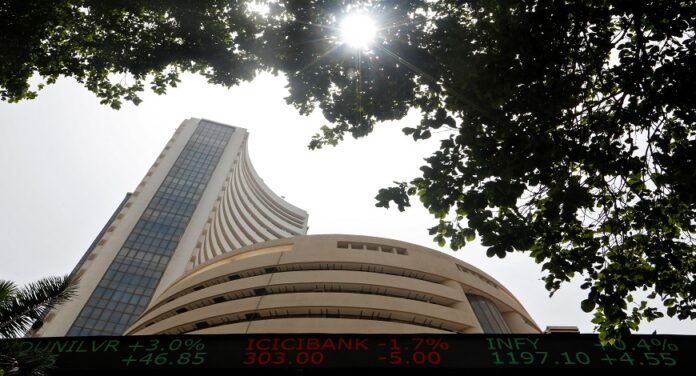

The Indian

equity markets have witnessed a splendid day of trade amid the follow-up buying

in the benchmark index. The across-board buying participation provided the

much-needed impetus to levitate the market sentiments. Amidst the action-packed

day, Nifty Future surged consecutively for the second time in the week and

concluded the session a tad above 18199.15, procuring 0.61 percent.

There have

been contributions across the board, wherein the significant benefactors that

boosted the bullish sentiments were from the Metal space. Looking at the recent

developments, the undertone is likely to remain bullish, wherein any dip could

be seen as a buying opportunity. Meanwhile, we advocate to keep Identifying apt

themes and potential movers within the same that are likely to provide better

trading opportunities and stay abreast with global developments.

Nifty futures

opened at 18112.00 points against the previous close of 18088.80 and opened at

a low of 18071.10 points. Nifty Future closed with an average movement of 153.50

points and a rise of around 110.35 points and 18199.15 points…!!

On the NSE,

the midcap 100 index will rise 0.52% and smallcap 100 index is closing rise 0.06%.

Speaking of various sectoral indices only PSU Bank and Auto stocks were seen

selling on the NSE, while all other sectoral indices closed higher.

At the start

of intra-day trading, February gold opened at Rs.56303, fell from a high of Rs.56450

points to a low of Rs.56122 with a rise of 71 points, a trend of around Rs.56423

and March Silver opened at Rs.69369, fell from a high of Rs.69669 points to a

low of Rs.69087, with a rise of 376 points, a trend of around Rs.69562.

After making a

cautious start, key gauges gained traction as traders took encouragement with

the Reserve Bank of India’s (RBI) report stating that states’ gross fiscal

deficit (GFD) is budgeted to decline from 4.1 per cent of gross domestic

product (GDP) in Covid-hit 2020-21 to 3.4 per cent of GDP in 2022-23 showing

improvement in their fiscal health. It stated the fiscal health of the states

has improved from a sharp pandemic-induced deterioration in 2020-21 on the back

of a broad-based economic recovery and resulting high revenue collections.

Sentiments

remained up-beat with a private report that nearly six in 10 corporate heads in

India (57 per cent) are optimistic about the country’s growth prospects in 2023

in the face of a global slowdown, as well as inflationary and geopolitical

concerns. Some support also came with report that the ongoing negotiations of

India for the proposed comprehensive free trade agreements with the UK and

European Union (EU) are on track and the next round of talks with both the

regions will happen soon.

Meanwhile, the

World Economic Forum in its Chief Economists Outlook survey said that a global

recession is likely in 2023, but pressures on food, energy and inflation may be

peaking. It added at the same time, some economies in the South Asia region,

including Bangladesh and India, may bennet from global trends such as a

divarication of manufacturing supply chains away from China.

Technically, the important key resistances are placed in Nifty future are at 18303 levels, which could offer for the market on the higher side. Sustainability above this zone would signal opens the door for a directional up move with immediate resistances seen at 18404 – 18474 levels. Immediate support is placed at 18108 – 18088 levels.

Note :- Before Act please refer & agree Terms & conditions, Disclaimer, privacy policy & agreement on www.nikhilbhatt.in